Founder: Emily Kirsch Portfolio (selected): Pearl Street Technologies, Solstice, Terabase, WattBuy, Station A, SHYFT, Leap, Energetic Insurance, Ensemble Energy, Raptor Maps Powerhousehas been recognized as a leader throughout 2020. It has only raised its first fund but was able to recruit a legit LP base.

Managing Partner: John Tough Portfolio (selected): Aurora, Drone Deploy, Jupiter, Sitetracker Energizehas close ties with Invenergy and thus leverages the partnership to quickly scale and commercialize its portfolio. The group also has key partnerships.

Managing Partners & Co-Founders: Joshua Posamentier, Abe Yokell Portfolio (selected): Camus, Omnidian, Leap, Energetic Insurance.

Managing Director: Brock Smith Portfolio (selected): ESS, Omnidian, Palmetto, WattBuy, Uplight, Innowatts Evergyis the non-regulated.

Contact online >>

Moonvalley Capital, Korkia (Finnish Alternative Investment Asset Manager) and Nala Renewables (Global power and renewable energy investment and development platform) formed a joint venture for the acquisition of a portfolio of 13 solar photovoltaic (PV) projects under development and construction in Chile from renewable energy developer Solek.

Dec 3, 2020· In this year like no other, solar, storage and cleantech investors are finding reasons for optimism — driven, in part, by an incoming Biden administration aiming to enact a $2 trillion

May 16, 2024· TotalEnergies is teaming up with a Chinese innovation investment fund co-developed by Cathay Capital and Dajia Insurance, to finance and operate solar power projects for commercial and industrial customers in China. This joint venture is the first time TotalEnergies works with the first innovative fund product in China that deeply integrates with the industry

Solar Venture is an IPP (Independent Power Producer) and developer focus on development, construction and financing of PV utility scale plants on global basis, with a particular focus on the Emerging Markets where is active since 2008 Solar Ventures has started its activity in 2005 with a leverage on the expertise of their founders in the

Investing in a nonprofit Solar Company that focuses on solar or solar installation for projects like water purification, schools, or electricity in countries with unstable power seems to be an ideal opportunity.

Oct 9, 2009· Responding to the Global Corporate Venture Capital Survey 2008-2009, by Ernst & Young, 35 percent of venture capitalists reported their company planned to increase cleantech investments in 2009.

Public capital investments concentrating solely on renewable energy were around $56 billion. In recent years, funds raised are approaching 25 times more than fossil-fuel asset fundraising. Recharge Venture Group is a private investment firm focused on small to medium sized acquisitions. We are a team of seasoned investors who like to work

Nov 1, 2021· The world''s largest concentrated solar power (CSP) plant, the Ouarzazate Solar or Noor Power Station with a 580 MW capacity, has been installed in Morocco, some IOCs have addressed the financing gap by funding new startups as corporate venture capital, prioritizing the funding of innovative startups working in the RE domain.

Aug 24, 2021· The Austin-based consultant said Californian firms accounted for three of the five largest venture capital and private equity deals signed in the first half, with residential solar finance

Jun 12, 2020· Span landed $10.2 million in venture capital last month to modernize and replace one of the more basic and ubiquitous pieces of home electrical hardware — the electrical

May 10, 2020· Figure 1: investment per region, Bloomberg New Energy Finance China tops the trend with ~80 bln USD invested over 2019, surpassing the US’ 55 bln.Next is Japan with 16.5 bln USD, followed by India with 9 bln USD and Vietnam (5.5 bln).. Drivers. There are three drivers behind the renewable market in Asia. Environmental is only a driver in East Asia (Japan,

In 2023, China led the pack in energy mega-rounds, channeling most venture capital to solar energy and battery materials startups. NET Power, a company focusing on clean natural gas power with carbon capture, exited in 2023 via SPAC with a $1.5 billion exit value after raising $150 million in total funding.

Jan 17, 2024· Perovskite solar startup Tandem PV announced it has raised $27 million in venture capital and government support and will use the funds to advance R&D and build its first manufacturing facility.. The latest $6 million funding round was led by existing investor Planetary Technologies, an early-stage venture capital firm with deep expertise in climate tech.

Nth Power is a venture capital firm based in San Francisco and is the first and most experienced venture capital firm. My target was to produce arrays for $15,000.00. I''m doing this so regular folk can have solar power for their prosperity. I look forward to your participation in this project. Please contact me with any questions you may

Advanced in-home monitoring system developed by Venture Solar; Single-day installations so you can start saving sooner **Our claims are truthful and substantiated. Why Venture Solar? Why not when you can experience the best the industry has to offer? Our certified in-house team provides our customers with the highest quality system available

To say that 2022 was a record year for investor interest in solar energy might actually be an understatement, Prabhu said. "If we go all the way back to 2010, we never had a year over $2 billion until" 2021, he said. "That''s pretty significant." Solar companies are also merging and being acquired at record rates, with 128 transactions in 2022.

Venture capitalists invested $7 billion in solar companies and projects in 2022, more than 50% greater than the $4.5 billion in solar-bound venture capital in 2021, according to a report by Mercom Capital Group.

Jan 17, 2023· Venture capitalists invested $7 billion in solar companies and projects in 2022, more than 50% greater than the $4.5 billion in solar-bound venture capital in 2021, according

CPV Begins Operations at Stagecoach Solar in Macon County, GA. News. CPV Publishes 2023 Sustainability Report. ABOUT US. Competitive Power Ventures is a leading North American electric power generation development and asset management company headquartered in Silver Spring, Maryland, with offices in Braintree, Massachusetts and Sugar Land

Nguyen Ho Nam, chairman of Bamboo Capital JSC, and Pham Minh Tuan, BCG Energy''s CEO, at the online signing ceremony to set up a joint venture for investing in rooftop solar and exploring other renewable energy sources in Vietnam with SP Group on July 30.

4 days ago· Venture Solar offers solar panel installation to homeowners who want to save money on their electric bills and reduce their carbon footprint. Venture uses high-quality solar panels for homes from LG as part of its installed system that incorporates efficient solar parts into a sleek and minimalist design. Read our review on Venture Solar offerings, financing, and installation

Our solar power investor introduction engine gives members access to our network of 12,000 solar energy investors and make introductions on your behalf. These warm introductions can lead to capital, new partnerships or executive talent. Venture Capital / Private Equity - Strategic CFO / Entrepreneurial Accountant: Great Northern Brands

But with few solar stocks available for public trading, venture capital is one of the few avenues for investors to play the entire solar field. It''s also telling, Prabhu said, where exactly investors have put their funds. Downstream technologies and companies—mainly solar developers and installers—have attracted the bulk of the attention.

Solar and renewable companies using artificial intelligence, solar storage, or digital monitoring are ideal investments for their future. This company is making strides in solar charging systems, data acquisition, and analysis.

May 10, 2020· Figure 1: investment per region, Bloomberg New Energy Finance China tops the trend with ~80 bln USD invested over 2019, surpassing the US’ 55 bln.Next is Japan with 16.5 bln USD, followed by India with 9 bln

Jan 18, 2024· Funding from solar venture capital activity was down 1% on last year, reaching $6.9 billion across 69 deals in 2023. From that figure, $4.7 billion (68%) went to 42 solar downstream companies.

Feb 6, 2024· The report tracks venture capital funding, public market, and debt financing into the solar sector, which totaled $34.3 billion raised in 160 deals in 2023. This compares to the 2022 total of $24.1 billion across 175 deals. Mercom said 2023 had the most corporate funding in

Jan 17, 2024· Mercom said solar companies raised about $20 billion in debt financing, also the highest amount in a decade. The report said that of the $6.9 billion in VC funding raised in 69 deals in 2023, $4.7

Feb 22, 2019· Venture capital is not the right tool to finance infrastructure. Instead, it is the right tool to finance business model innovation, which in turn allows adaption. Today, neither technology nor cost is holding back the deployment of more renewables (at least those mature ones like solar and onshore wind).

The SPI Network comprises more than 9,000 solar angel, family office, venture, special situations, private equity, and infrastructure investors in addition to 4,000 company executives, service professionals, and regulatory staff.

Feb 7, 2024· The report tracks venture capital funding, public market, and debt financing in the solar sector, which totaled $34.3 billion raised in 160 deals in 2023. This compares to the total of $24.1

Here are some tips and tricks for securing venture capital for solar power companies: Research and target venture capital firms that have a track record of investing in renewable energy or green technology companies. Prepare a concise and compelling pitch deck that clearly outlines the need for funding, the potential market size, and the

Oct 13, 2020· In an effort to continue expansion within the clean energy industry, Inovateus Solar has announced the formation of Brilliant Capital, a solar project financing venture. Brilliant Capital is a joint undertaking of Middleburg Capital Development (MCD) and LogiKan Group and will augment the core capabilities of Inovateus'' development

Jan 18, 2024· Funding from solar venture capital activity was down 1% on last year, reaching $6.9 billion across 69 deals in 2023. From that figure, $4.7 billion (68%) went to 42 solar

Dec 3, 2020· Venture capital funding in solar, storage and energy intelligence sees a year-end surge $39 million for next-gen concentrated solar power: Bill Gross''s CSP startup Heliogen received $39 million, to "develop, build, and operate a supercritical carbon dioxide power cycle integrated with thermal energy storage,

From that figure, $4.7 billion (68%) went to 42 solar downstream companies. Solar companies raised $1.9 billion, balance of system companies raised $311 million and service providers raised $32 million. Mercom Capital Group CEO Raj Prabhu said investments into solar continue to defy expectations.

Jun 12, 2020· Span landed $10.2 million in venture capital last month to modernize and replace one of the more basic and ubiquitous pieces of home electrical hardware — the electrical panel. Span''s ambition is to "transform the electrical panel into an intelligent gateway" and help expand the adoption of solar, energy storage and EVs.

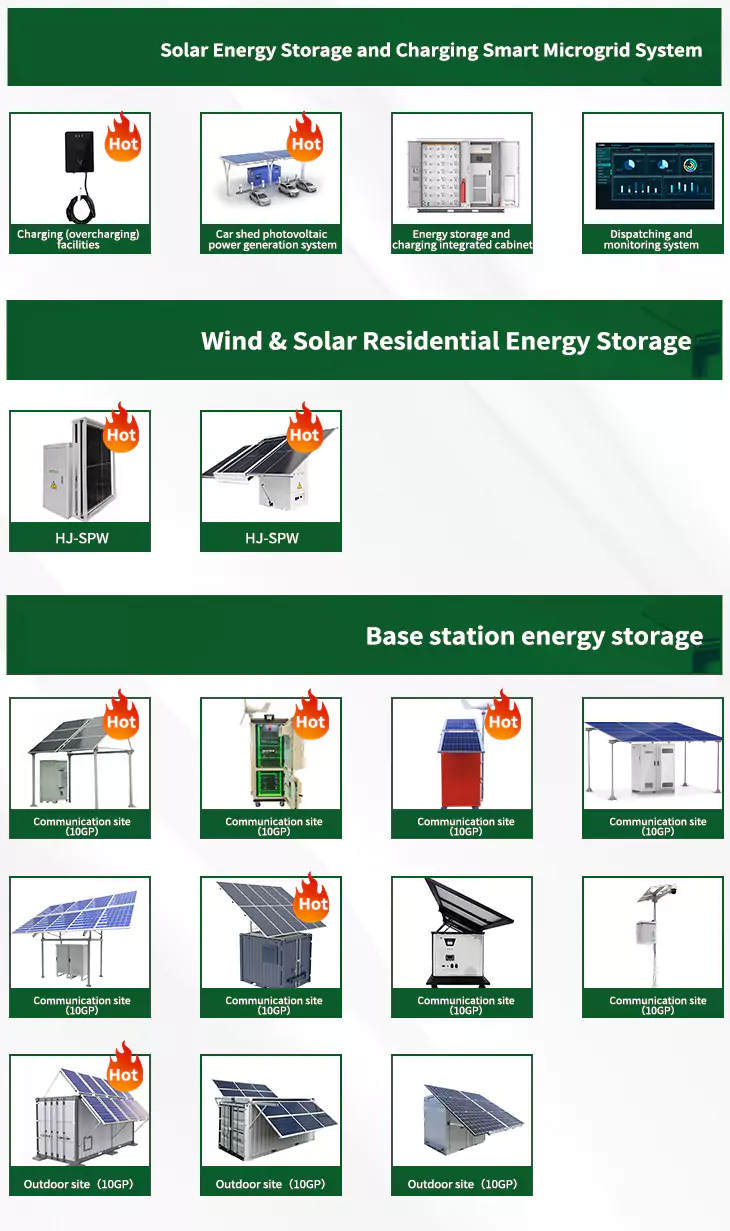

As the photovoltaic (PV) industry continues to evolve, advancements in solar power venture capital have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

When you're looking for the latest and most efficient solar power venture capital for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various solar power venture capital featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

Enter your inquiry details, We will reply you in 24 hours.